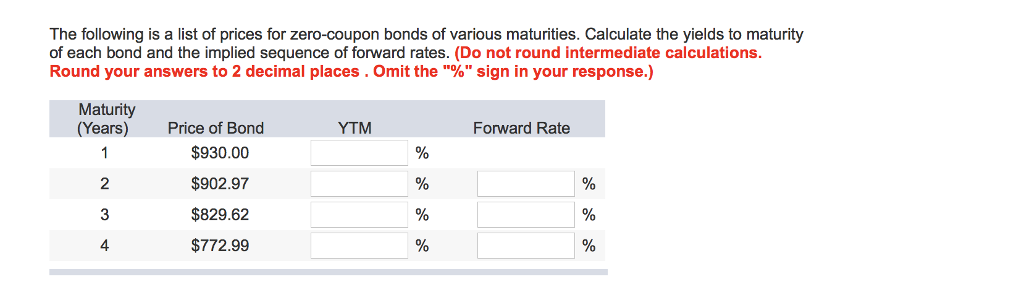

44 yield to maturity of coupon bond

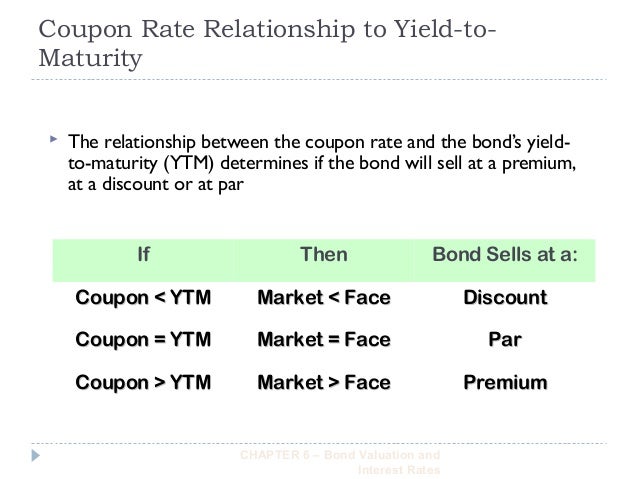

Yield to Maturity (YTM) - Overview, Formula, and Importance Assume that there is a bond on the market priced at $850 and that the bond comes with a face value of $1,000 (a fairly common face value for bonds). On this bond, yearly coupons are $150. The coupon rate for the bond is 15% and the bond will reach maturity in 7 years. The formula for determining approximate YTM would look like below: Concept 82: Relationships among a Bond's Price, Coupon Rate, Maturity ... The yield-to-maturity is the implied market discount rate given the price of the bond. Relationship with bond's price. A bond's price moves inversely with its YTM. An increase in YTM decreases the price and a decrease in YTM increases the price of a bond. The relationship between a bond's price and its YTM is convex.

Understanding Coupon Rate and Yield to Maturity of Bonds To translate this to quarterly payment, first, multiply the Coupon Rate net of 20% final withholding taxes by the face value (1.900% x 1,000,000). Then, divide the resulting annual amount by 4. Here's a sample of how you can compute your expected coupon income from your bond: Php 4,750.00 is the income you can expect to receive quarterly.

Yield to maturity of coupon bond

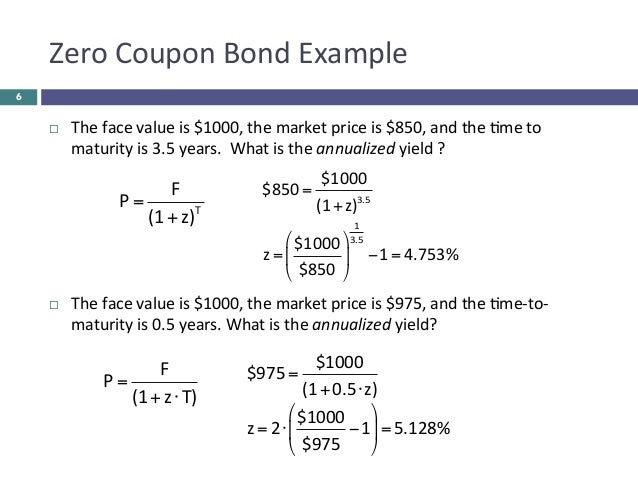

Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Calculating Yield to Maturity on a Zero-coupon Bond YTM = (M/P) 1/n - 1 variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value P = price n = years until maturity Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years. Yield to Maturity vs. Coupon Rate: What's the Difference? The yield to maturity (YTM) is an estimated rate of return. It assumes that the buyer of the bond will hold it until its maturity date, and will reinvest each interest payment at the same interest... Yield to Maturity Calculator | Good Calculators r = 6.48%, The Yield to Maturity (YTM) is 6.48% You may also be interested in our free Tax-Equivalent Yield Calculator Rating: 4.3 /5 (208 votes)

Yield to maturity of coupon bond. Zero-Coupon Bond: Formula and Excel Calculator To calculate the yield-to-maturity (YTM) on a zero-coupon bond, first divide the face value (FV) of the bond by the present value (PV). The result is then raised to the power of one divided by the number of compounding periods. Zero-Coupon Bond YTM Formula Yield-to-Maturity (YTM) = (FV / PV) ^ (1 / t) - 1 Zero-Coupon Bond Risks Basics Of Bonds - Maturity, Coupons And Yield Current yield is the bond's coupon yield divided by its market price. To calculate the current yield for a bond with a coupon yield of 4.5 percent trading at 103 ($1,030), divide 4.5 by 103 and multiply the total by 100. You get a current yield of 4.37 percent. Say you check the bond's price later and it's trading at 101 ($1,010). Yield to Maturity Calculator | Calculate YTM In the yield to maturity calculator, you can choose from six different frequencies, from annually to daily. In our example, Bond A has a coupon rate of 5% and an annual frequency. This means that the bond will pay $1,000 * 5% = $50 as interest each year. Determine the years to maturity The n is the number of years from now until the bond matures. Yield to Maturity (YTM): Formula and Excel Calculator From the perspective of a bond investor, the yield to maturity (YTM) is the anticipated total return received if the bond is held to its maturity date and all coupon payments are made on time and are then reinvested at the same interest rate. In This Article What are the steps to calculating the yield to maturity (YTM) in Excel?

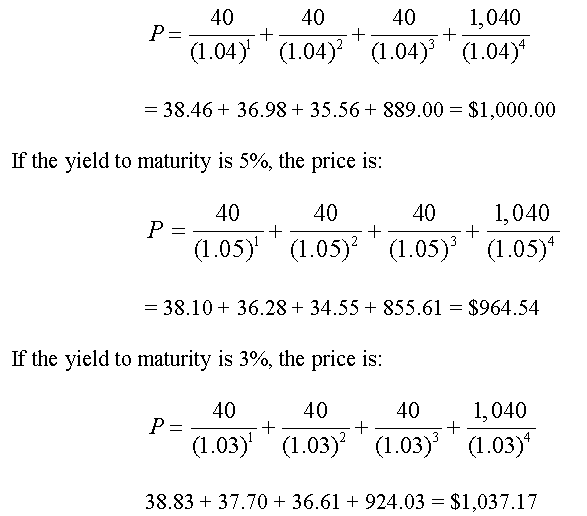

Yield to Maturity (YTM) - Meaning, Formula & Calculation Using the YTM formula, the required yield to maturity can be determined. 700 = 40/ (1+YTM)^1 + 40/ (1+YTM)^2 + 1000/ (1+YTM)^2 The Yield to Maturity (YTM) of the bond is 24.781% After one year, the YTM of the bond is 24.781% instead of 5.865%. Hence changing market conditions like inflation, interest rate changes, downgrades etc affect the YTM. Yield to Maturity vs Coupon Rate - Speck & Company Yield to Maturity (YTM) is the expected rate of return on a bond or fixed-rate security that is bought by an investor and held to maturity. Coupon rate is a fixed value in relation to the face value of a bond. If yield to maturity is greater than the coupon rate, the bond is trading at a discount to its par value. How to Calculate Yield to Maturity: 9 Steps (with Pictures) , where, P = the bond price, C = the coupon payment, i = the yield to maturity rate, M = the face value and n = the total number of coupon payments. If you plug the 11.25 percent YTM into the formula to solve for P, the price, you get a price of $927.15. A lower yield to maturity will result in a higher bond price. Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions.

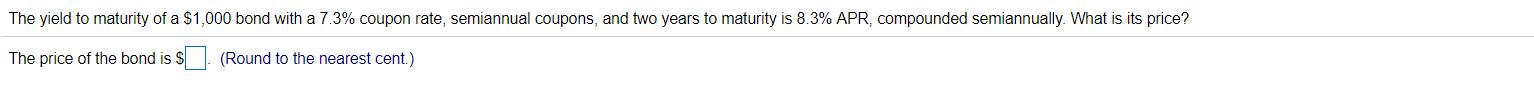

Bond Yield to Maturity (YTM) Calculator - DQYDJ This makes calculating the yield to maturity of a zero coupon bond straight-forward: Let's take the following bond as an example: Current Price: $600. Par Value: $1000. Years to Maturity: 3. Annual Coupon Rate: 0%. Coupon Frequency: 0x a Year. Price =. (Present Value / Face Value) ^ (1/n) - 1 =. Yield to Maturity | Formula, Examples, Conclusion, Calculator The approximate yield to maturity of this bond is 11.25%, which is above the annual coupon rate of 10% by 1.25%. You can then use this value as the rate (r) in the following formula: C = future cash flows/coupon payments r = discount rate (the yield to maturity) F = Face value of the bond n = number of coupon payments Yield to Maturity (YTM) Definition & Example | InvestingAnswers The yield to maturity is the percentage of the rate of return for a fixed-rate security should an investor hold onto the asset until maturity. The coupon rate is simply the amount of interest an investor will receive. Also known as nominal yield or the yield from the bond, the coupon rate doesn't change. Simply put, it is the total value of ... How to Calculate the Price of Coupon Bond? - WallStreetMojo Let us take an example of bonds issued by company ABC Ltd that pays semi-annual coupons. Each bond has a par value of $1,000 with a coupon rate of 8%, and it is to mature in 5 years. The effective yield to maturity is 7%. Determine the price of each C bond issued by ABC Ltd. Below is given data for the calculation of the coupon bond of ABC Ltd.

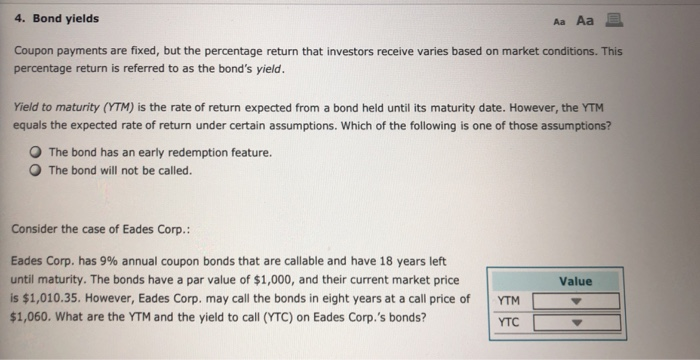

Solved Question 1 of 71 The yield to maturity on a coupon - Chegg Finance. Finance questions and answers. Question 1 of 71 The yield to maturity on a coupon bond is … · always greater than the coupon rate. · the rate an investor earns if she holds the bond to the maturity date, assuming she can reinvest all coupons at the current yield. · the rate an investor earns if she holds the bond to the maturity ...

PDF Yield-to-Maturity and the Reinvestment of Coupon Payments Yield-to-Maturity and the Reinvestment of Coupon Payments Shawn M. Forbes, John J. Hatem, and Chris Paul 1 ABSTRACT This note addresses a common misconception, found in investment texts and popular investment education literature, that in order to earn the yield to maturity on a coupon bond an investor must reinvest the coupon payments.

Bond maturity value calculator The maturity payment is typically the par value of the bond. So on a bond with a par value of $1,000 and a coupon rate of 5%, you'll typically get $1,025 at maturity: $25 as your last semi-annual interest payment plus the $1,000 par value. Proceeds from sales of bonds before maturity When you sell a bond before maturity, things get more.

Zero Coupon Bond Yield - Formula (with Calculator) For example, an investor purchases one of these bonds at $500, which has a face value at maturity of $1,000. Although no coupons are paid periodically, the investor will receive the return upon maturity or upon sell assuming that the rates remain constant. Zero Coupon Bond Effective Yield Formula vs. BEY Formula. The zero coupon bond effective ...

Solved The yield to maturity of a $1,000 bond with a | Chegg.com ANSWER: Bond Price = $ 985.46 Working: PARTICULARS in formulae Values Par value of Bond FV 1000 Coupon Rate Per annum 7.10% Coupon R… View the full answer Previous question Next question

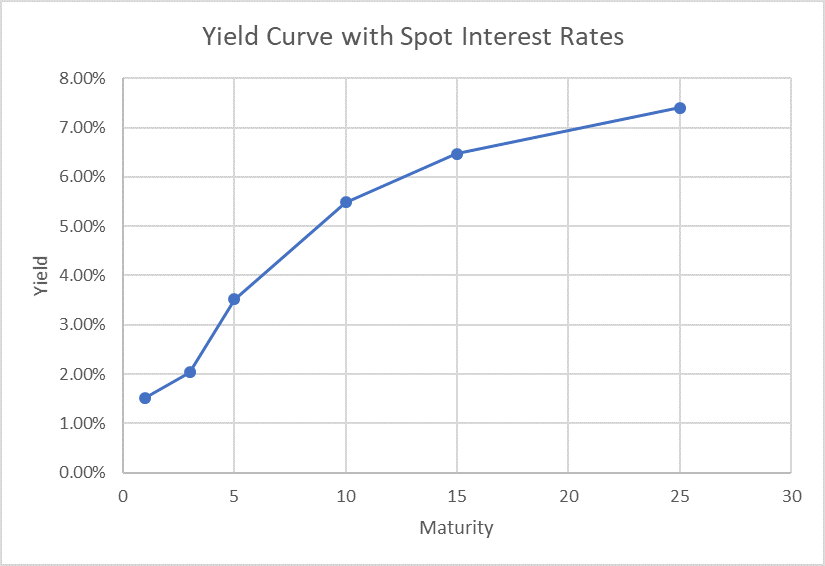

Yield to Maturity (YTM) Definition - Investopedia Yield to maturity is similar to current yield, which divides annual cash inflows from a bond by the market price of that bond to determine how much money one would make by buying a bond and holding...

Important Differences Between Coupon and Yield to Maturity The yield increases from 2% to 4%, which means that the bond's price must fall. Keep in mind that the coupon is always 2% ($20 divided by $1,000). That doesn't change, and the bond will always payout that same $20 per year. But when the price falls from $1,000 to $500, the $20 payout becomes a 4% yield ($20 divided by $500 gives us 4%).

Yield to Maturity (YTM) - Definition, Formula, Calculations Use the below-given data for calculation of yield to maturity. Coupon on the bond will be $1,000 * 7.5% / 2 which is $37.50, since this pays semi-annually. Yield to Maturity (Approx) = ( 37.50 + (1000 - 1101.79) / (20 * 2) )/ ( (1000 + 1101.79) / 2) YTM will be - This is an approximate yield on maturity, which shall be 3.33%, which is semiannual.

Difference Between Coupon Rate and Yield of Maturity 1. The amount paid by the issuer to the bondholder until it's maturity is called coupon rate. The yield of maturity means the total return earned by the investor until it's maturity. 2. The rate of interest is paid annually at a coupon rate. The current Yield defines the rate of return it generates annually.

Yield to Maturity Calculator | Good Calculators r = 6.48%, The Yield to Maturity (YTM) is 6.48% You may also be interested in our free Tax-Equivalent Yield Calculator Rating: 4.3 /5 (208 votes)

Yield to Maturity vs. Coupon Rate: What's the Difference? The yield to maturity (YTM) is an estimated rate of return. It assumes that the buyer of the bond will hold it until its maturity date, and will reinvest each interest payment at the same interest...

Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Calculating Yield to Maturity on a Zero-coupon Bond YTM = (M/P) 1/n - 1 variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value P = price n = years until maturity Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years.

:max_bytes(150000):strip_icc()/dotdash_Final_Par_Yield_Curve_Apr_2020-01-3d27bef7ca0c4320ae2a5699fb798f47.jpg)

Post a Comment for "44 yield to maturity of coupon bond"